No matter what industry you’re in, your biggest marketing tool is a website.

Why?

Because it’s where a person goes to learn about your business. In fact, 97% of consumers research products and services online before they make a purchase decision.

In today’s internet age, creating a professional website for your insurance agency is tantamount to printing business cards. By optimizing for local SEO, you can use your website to:

- Build brand awareness

- Promote your services

- Generate leads

Simply put, your website could be a potential customer’s first and last stop in searching for an insurance agent online. As such, it needs to be professional, user-friendly, and functional.

Most insurance professionals aren’t web developers, though—so how do you ensure your website meets all of these requirements?

Hiring a web designer or company is an obvious and effective choice for building and maintaining a quality website. But if you’re interested in setting up your business’s online presence yourself, there are plenty of website builders to help.

Below are 15 of the top insurance website builders available, including industry-specific platforms as well as universal website-building options.

Check out each option to see which solution best meets your budget, skill level, and time required in setting up an insurance website.

Please note, we only recommend a DIY insurance website builder for temporarily getting your business online, never as a long term marketing strategy.

Leadsurance

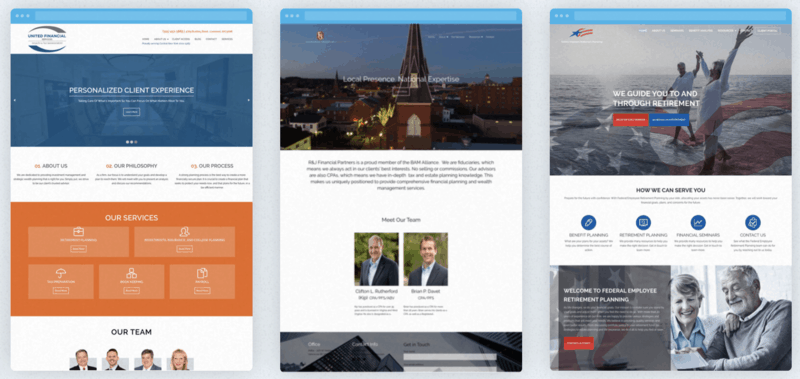

Leadsurance is much more than an insurance website builder and we recommend you invest more into your website than a low-cost DIY option.

We are a team of professional insurance website designers and marketers that come paired with a powerful suite of marketing tools for you to create awesome blog content, send email campaigns to 10,000 contacts and convert more website visitors into warm leads with our insurance chatbot.

You spend about 20-30 minutes on a design call with an experienced professional and then our team customizes a fully-featured professional insurance website for you. You will get to review it and request changes through multiple rounds of feedback before going live on your domain.

With Leadsurance you get:

- A customized and mobile-optimized insurance website built by us, for your brand

- A blogging platform with newsletter and social automation

- A drag-n-drop webpage builder

- An email campaign builder and marketing tools for up to 10,000 contacts

- Social media automation tools

- Online review requests and displays with built-in reputation management

- Premium hosting and SSL security

- Quoting forms and real-time lead alerts

- 24-hour support by specialists in digital marketing for insurance agencies

Learn about our insurance web designs that we’ve done for hundreds of agencies

Get started setting up your website

Learn about our insurance chatbot

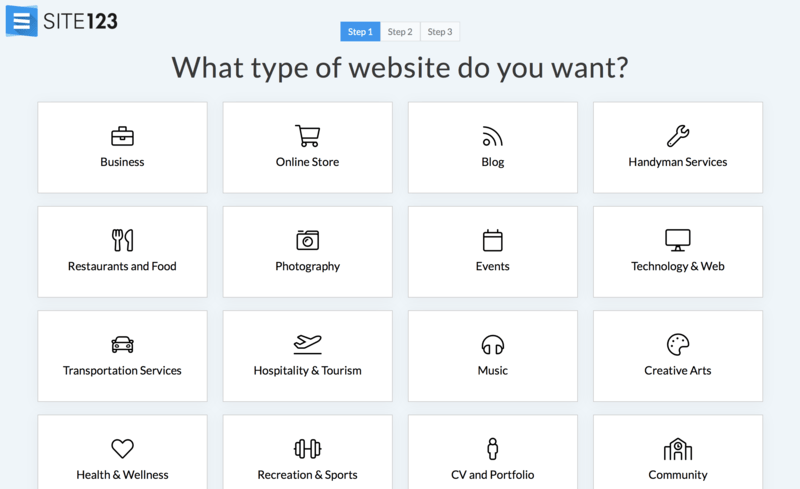

Site123

Although it should only be used as a temporary solution to getting your insurance agency online, Site123 is easy to use. Any website created with Site123 is going to be bare-bones basic. Extremely simplistic without many features.

Ease of use is Site123’s claim to website-building fame. Perfect for those completely new to website development, the service offers a no-coding solution through its intuitive web editor. You can find hosting and domain registration for your insurance website, along with a few basic SEO tools and a responsive templated design. All it takes is a setup process of three steps.

Site123 also has a template library for a number of businesses and purposes; however, it’s not distinctly geared toward the insurance industry.

Editor’s Note: This Site123 generic website builder, along with Wix and the other half dozen generic DIY site builders we share in this post, are not built on WordPress. WordPress powers the majority of websites that publish content for marketing purposes and have strong SEO, these other generic website template builders are not designed for SEO and generally won’t rank well nationally or for local SEO terms.

Interested in SEO? Checkout our beginner’s guide to insurance SEO and our advanced guide to SEO for insurance agents.

Wix

Wix is another quick and temporary solution to getting your business online, you won’t find any long-time successful insurance websites built on Wix.

While any business owner can use Wix to create a website, the tool is comprehensive enough to include a template specifically for insurance companies. It’s perfect for those who know they don’t need many website features like a business blog. (But we definitely recommend blogging for insurance agents)

To begin, first-time Wix users must select one of two modes for building their website:

- A standard WYSIWYG content editor

- Wix Artificial Design Intelligence, which independently creates a site based on the user’s responses to a few questions

Beyond site-building, Wix also offers a custom logo maker—perfect for insurance agents just starting out or looking to revamp their branding.

Wix provides a variety of options when it comes to building your website and will take you a few hours to learn and set up. Be aware, though, that if the world of web editing is completely foreign to you, limitless choices may handicap productivity and decision-making.

Advisor Websites

This next option costs more time and money but provides a fairly complete solution to getting your insurance business online. Bear in mind, you will spend quite a bit of time learning and managing your website with this platform.

The Advisor Websites platform is a niche financial and insurance website builder. Since it understands the industry, it offers features that any insurance agent would want to see on their website, including:

- Lead management for exporting your website leads and then importing them into your CRM software

- An industry-specific content library to use on your website and customize for your audience

- Compliance engine for one-click compliance submissions, pre-approved broker-dealer content, and bulk submissions in order to streamline the review process

Advisor Websites’ builder lets you first choose from six website templates for your site and then personalize the configuration to match your brand.

The drawback to using this builder for your insurance business is that, like most DIY website builders, your site will most likely fall into the basic, cookie-cutter category of professional sites. In other words, it’s not ideal for those that want to create a more high-tech, personalized user experience.

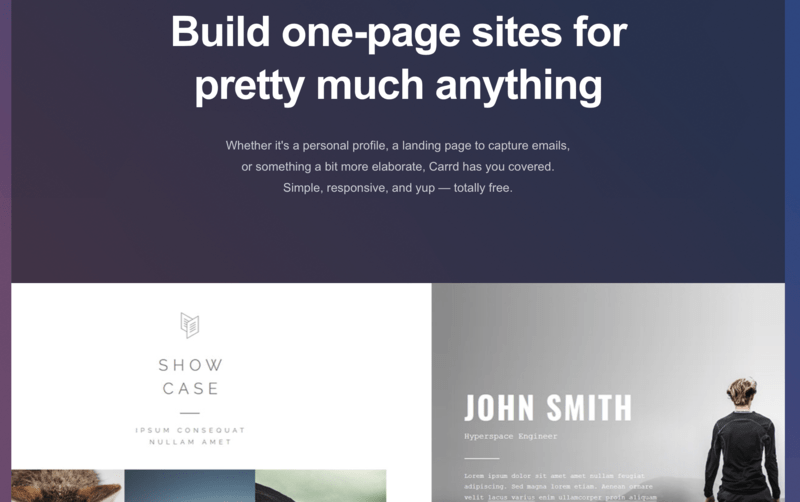

Carrd

Back to a quick temporary solution for simply getting your insurance agency online.

Carrd is the ideal builder for the insurance agent that needed a website yesterday and wants a simple, clean piece of the web to house their business page.

It’s powerful, easy to use, and offers a nicely designed editor for one-page websites. While most business websites today comprise multiple pages, a single-page website isn’t unheard of. With minimalism perpetually in vogue, Carrd’s builder provides a modern, simplistic website that’s easy to maintain.

Of course, the service does offer an upgraded package if you’re looking for more than just a landing page. This Pro version of Carrd comes in three plans—Lite, Standard, and Plus—with varying levels of functionality.

InsuranceSplash

This solution has been around a long time and their website hasn’t been updated in 5 years. So, we aren’t sure we would recommend signing up for this service anymore, however, back in the day, this was a decent option for building insurance websites on a low budget.

InsuranceSplash offers a comprehensive insurance website builder for agents and professionals to build their own site. Its top features include:

- Insurance product pages

- Online quote forms and contact page templates

- A built-in blogging platform

- A customizable client document library

- Additional personalization with an agency news page and agent photo gallery

The tool gives a 72-hour site launch timeline and also offers an easy drag-and-drop editor. So even if you have no experience in creating web pages, you’ll still be able to arrange your content and format it to your liking.

The downside? InsuranceSplash utilizes a templated website and content which gravitates heavily toward stock photos and generic graphics, which could mean an outdated look and design for your own site.

Squarespace

If your main goal is to simply get a branded webpage online then this option will suffice. If you need a website with multiple content pages and features, then we wouldn’t recommend this solution.

Squarespace is a big name in the website builder industry, and for good reason. Its dynamic platform has you covered from hosting to design to analytics—in fact, it’s hard to find a feature that Squarespace doesn’t offer.

Its page templates are high-quality, current, and mobile-responsive. Functionality is built right into the editor rather than found in an app store, and you can even add on tools for email marketing and appointment scheduling.

One especially helpful feature for any insurance website is Squarespace’s customer accounts offering—the perfect tool for your clients to handle claim filings, bills, and more. This feature, however, is only for the highest-priced tier of membership offered by Squarespace.

On that note, Squarespace’s service runs at a steeper cost compared to builders that offer a free version. Other drawbacks include a slightly awkward editing tool and a limit to the depth of navigation you can build your site out to.

ITC

This solution is ideal for seasoned insurance agencies that have the time and budget to pay for managed services. This solution is most similar to Leadsurance, however, requires a larger investment.

ITC will build your insurance website with the support of experts in your industry.

Simply choose a template and communicate your goals—then ITC’s team will handle the rest. Quote and customer service forms are popular design options to choose from, and your site will be built optimized for search engines.

Compared to other builders, ITC has a slower turnaround time of two weeks to get your site up and running. Also, it’s a niche-specific service, which helps when you’re talking goals and standard components for your insurance website—but it can mean fewer options and more limits to your creativity than what a broad-based website builder could provide.

uKit

Another quick and dirty solution to simply getting an insurance webpage online for your business.

uKit offers a no-coding solution to building your website. Instead, users work with their pre-existing content, adjusting it to their specific needs to create their very own site.

While uKit is a universal website solution, it can still be thought of as a powerful insurance website builder because of its 10 templates for the finance and insurance industries. The templates hit all the marks needed in an insurance site, and user functionality is smooth.

Additionally, uKit’s “smart wizard” walks users through every step of the process so that they’re not left wondering where to start.

The company also claims to mesh the latest trends in technology with old tried-and-true methods for a platform like no other. Simple and fast, the builder is a solid choice for insurance agents just starting out in website development and willing to forgo other free website building options.

Strikingly

Yet another incredibly simple tool for quickly building a very basic insurance website.

Like Carrd, Strikingly specializes in the one-page format and design.

No coding or design skill is needed, and with what it calls the “easiest website editor possible,” you can bring your insurance website to life in mere minutes.

Simplicity is the key to this tool’s appeal, but Strikingly still offers all the fundamentals, including:

- Domain names and site security

- Signup and contact forms

- A simple blog and social feed

- An analytics dashboard

Strikingly has been around since 2012, making it a younger name in the website-building arena. Of all areas that could be improved upon, its SEO capabilities are not obviously highlighted, and the free version of the tool is only going to get you so far.

Webflow

Like the many before it, this solution is ideal for quickly creating a simple insurance website.

Webflow is a universal site creator that can easily serve as your insurance website builder.

It offers a wide range of well-designed templates across several industry categories like startup, healthcare, podcasts, and more. These templates are highly customizable, making it easier for your site to stand out from the crowd—but using the editor can be cumbersome for a beginner.

On the plus side, Webflow integrates nicely with other marketing tools like Mailchimp and Google Analytics. It also offers the power to build website animations and interactions for a rich visual experience.

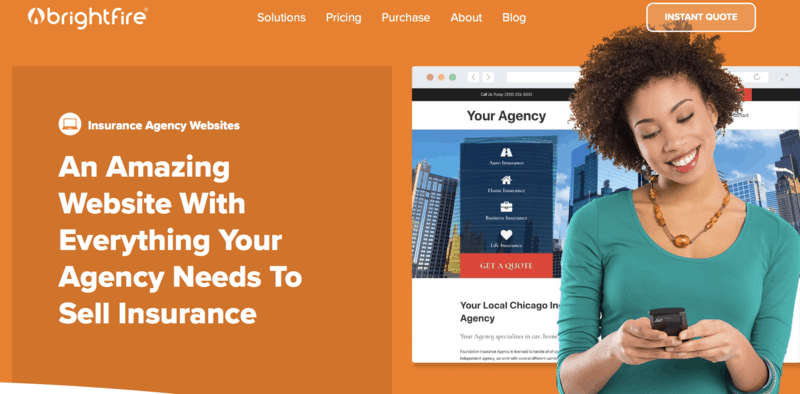

BrightFire

This solution costs a bit more time and money but will offer a few more advanced insurance website features than many of the DIY builders listed today. That said, the designs and content are templated and cookie-cutter, definitely not custom.

The BrightFire platform is a customizable insurance website builder designed to help you better engage with customers and manage your staff.

BrightFire is all about providing its users with a personalized touch—from sales tools to content—for their respective audience. The services accomplishes this through features like:

- Private video proposals for prospects

- Ready-to-go blog posts and product pages

- Pre-loaded forms for lead generation and customer service

- My Agent Personalization, a tool that lets your team add their own touch throughout your site

The platform also comes with a content editor that’s easy to use, and websites are built to be SEO-friendly and mobile-responsive. Unfortunately, as great as it sounds, negative reviews describe BrightFire’s content as “canned” and unoriginal.

IM Creator

This is a low cost option with basic capabilities for building an insurance website.

For insurance agents who have a greater understanding of web design and development, IM Creator is a builder worth looking into.

Using this service, you can change how your website looks on mobile and integrate your blog seamlessly. All design elements stay aligned to your theme, so you can keep your brand consistent and clear. On that note, IM Creator’s design and capabilities are stunning, but its editor isn’t as user-friendly, especially if you’re a beginner.

One small positive, though: The platform is meant to provide you with the ability to scale your insurance website content in the future by adding new pages.

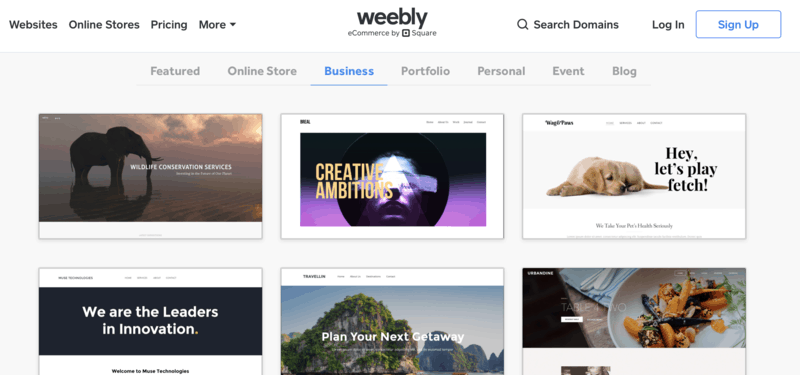

Weebly

This solution is good for getting started with a basic insurance website.

Weebly is a fine choice for simplicity, ease of use, reliable site speed, and a wide variety of templates and apps to choose from to build your insurance website.

Two extra perks that come with Weebly include a free SEO report—along with SEO-friendly designs and templates—and the ability to easily export your site to another website builder if you decide it’s the right move in the future. Other platforms like Wix make this transition much more difficult.

As for the downfalls of the Weebly platform, you’re generally limited in your options for blogging and photo editing. So if images are important for your website, you’re better off editing photos off of Weebly before importing them.

AgentMethods

This solution requires a steep minimum setup fee of $399 and only offers very dated templated designs. However, some older insurance agencies seem to like them. If you don’t mind sharing dated designs with other agencies then you can try this website builder.

AgentMethods claims that by using its service, you can launch your website in one day. It offers SEO- and mobile-friendly site templates specifically for the insurance industry and even boasts a content library with boilerplate messaging for your site, social channels, and email campaigns.

Another solid feature AgentMethods provides is a lead pop-up tool, which is similar to Leadsurance’s insurance chatbot but not quite as user friendly or advanced. This handy feature displays unique messaging on different parts of your site, with the goal of encouraging users to interact and share their email address. Once your site receives a lead’s information, AgentMethods will send you an alert every time that lead revisits your site.

While this website builder is specifically tailored for insurance companies, AgentMethods’ functionality is generally limited to the basics. This means you simply don’t have much room for extensive site customization and your site will come out looking exactly like your competitors using this platform.

The Bottom Line

The number of site builders available on the web can be exhausting when hunting for the right fit for your insurance website. The 15 listed above are only a fraction of those out there but highlight the most reputable and well-known.

While a website builder makes for a good starting point, its biggest limitation is that it can only offer at best a templated design with minimal customization that thousands of other insurance agents are also using.

The best way to distinguish your business from the competition is to hire a professional web designer or agency, which will go a step further than generic site builders. They’ll meet with you to discuss your needs and learn about your agency and clientele—whatever it takes to deliver a polished, functional website built with your target customer in mind.