For the past 10 years, the CMO Survey has been conducted twice each year, polling Chief Marketing Officers of hundreds of U.S. for-profit companies.

The mix of those companies consists of both B2B and B2C companies, across all industries, including insurance companies.

If you are asking how much do insurance companies spend on marketing? Then the CMO survey data is one place to look.

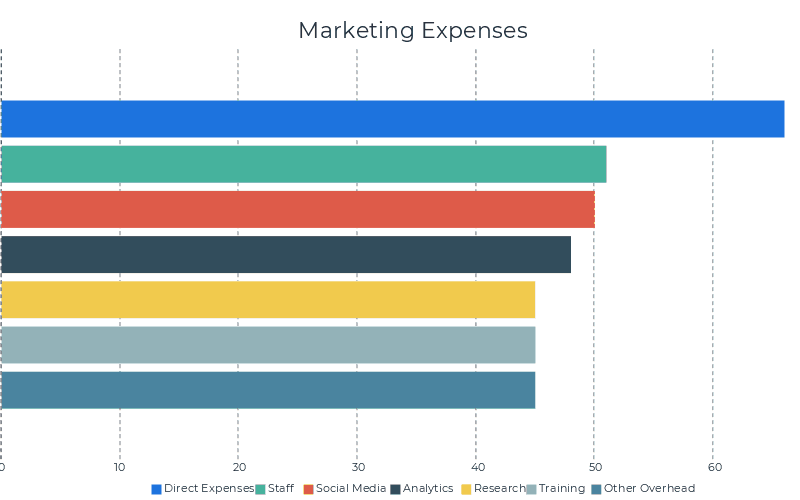

Specifically, the chart showing a breakdown of the survey respondent’s marketing expenses is helpful.

45% – 66% of insurance companies report incurring the following marketing expenses:

- 66% Direct Expenses of Marketing (advertising, trade promotions, and direct marketing)

- 51% Marketing Employees

- 50% Social Media Marketing Costs

- 48% Marketing Analytics Subscriptions and Fees

- 45% Marketing Research Expenses

- 45% Marketing Training Costs

- 45% Other Overhead Costs

The survey makes it clear that there are distinct differences in how much money is spent on marketing in various industries, with companies involved in consumer packaged goods spending by far the most money on marketing activities, at around 24% of their total budget.

Whereas energy companies, only typically spend 4% of their total budget on marketing.

Somewhere in the middle is where insurance companies fall in, at approximately 8% of their total budget being allocated to marketing.

How much insurance agencies spend on marketing services

Sources other than the CMO Survey also show that insurance agencies spend around 8% on marketing expenses.

The SBA reports similar insurance agency spending data as the CMO survey reports.

The Small Business Administration (SBA) recommends businesses generating under $5 million in annual revenue should allocate 7-8% of its total budget to marketing. Further, the SBA says actual expenses will vary by industry and can surpass 20% in certain consumer-focused industries.

So, for example, let’s use $1M in annual revenue since it is an easy number.

$1,000,000 x .08% = $80,000 in annual marketing spend

In addition to these surveys, other insurance marketing publications share insights as well.

- The cost of hiring a freelance social media manager is between $1,000 to $2,500 per month

- Buying content costs between $50 to $150 for a high-quality blog post and even more for video content

- Website design work can vary greatly depending on the extent of the work, but expect to pay anywhere from $500 to $5,000

- Facebook ads can be bought for as little as $5 per day

Although that last statement is true, you will likely need to spend quite a bit more than $5 on Facebook Ads to generate many leads.

Statistics on insurance companies’ marketing spend

The digital revolution has completely changed the way people purchase insurance, and recent surveys confirm the fact that technology is playing a bigger and bigger role in fueling growth for insurance companies.

In the insurance industry, marketing spend is very closely associated with revenue growth, no matter what the size may be of an insurance company.

Insurance companies using marketing automation sell 20% more policies per producer, and 10% more per household, and companies using lead management drove 43% more policies per producer, and 13% more policies per household.

This should make it clear that technology is a major factor in driving insurance sales, and that’s why a significant part of most insurance companies’ marketing spend is allocated toward technology.

A recently conducted survey by Velocify found that insurance companies which spent more than 15% of their total revenues on marketing were much more likely to experience significant growth.

By contrast, those insurance companies which invested more than 15% of their total revenues experienced a 20% increase in revenues, constituting major growth.

Can there be a downside to spending more on marketing?

Generally speaking, the more an insurance company spends on marketing, the bigger its return will be and the greater will be the chance for revenue growth.

However, it is possible to lose focus on customer retention in the rush to find and court new customers in the insurance business.

In fact, the survey found that as a rule, the more money which companies spent on marketing, the lower their average retention rate.

The obvious approach to countering this undesirable development would be to continue to spend more money on marketing but to be sure that customer retention is one of the strong themes included in marketing campaigns.

This is another area where marketing automation can add value to existing policyholders while attracting new business.

Automating your communications makes it painless to bring attention to policy renewals, educate clients and announce new products or offers to existing clients and new prospects.

When all these marketing activities can be carried out automatically, it tends to reverse the negative statistics which illustrate that companies spending 15% or more of their revenues on marketing have only an 81% retention rate, whereas companies spending less than 5% on marketing have an 86% customer retention rate.

At Leadsurance, we built our insurance marketing automation solution with your existing clients in mind.

Creating value for your policyholders is one of the ways Leadsurance builds trust, advocacy, and generates referrals, meanwhile we also automate the process of attracting new leads.

You may be surprised at how powerful our chatbot is.

So, How Much do Insurance Companies Spend on Marketing?

Answering the question, how much do insurance companies spend on marketing, isn’t completely straightforward.

It requires looking at many data sources and drawing relevant insights for your business.

One major insight we found is that growth for insurance companies will continue to be closely tied to total marketing spend, with the most successful companies being those which invest most heavily in marketing.

However, among these most successful companies, the ones which will be at the very top will be those which spend heavily on marketing that focuses on customer retention.

There are still tremendous opportunities for acquiring new customers as well.

In fact, a recent survey from Communispace has found that less than half of all millennials believe that insurance should be part of any program for maintaining wellness and general health.

Just this one example shows that reaching the millennial demographic with the appropriate message means a huge new audience can be tapped by insurance companies.

Questions about how much insurance companies spend on marketing? Let’s talk in the comments below.