Social media for insurance companies and agents has its challenges.

However, social media has become crucial to the insurance business.

Plus, the rewards insurance agencies are reaping on social media outweigh the challenges.

Insurance agencies should take a practical approach to social media to ensure compliance, avoid pitfalls and enjoy the benefits.

Today we are going to discuss how to take a practical approach to social media for insurance agents following these 11 proven steps.

Getting Started and Engaging on Social Media

In 2019, brands and businesses, insurance agencies included, are expected to have a minimal social presence of at least Facebook and/or Twitter profiles.

“According to the Pew Research Center, 75% of American men and 83% of American women use Facebook”

“According to LIMRA, 93% of Life Insurance Companies had established a social media presence by 2015”

If you’re going to have social media for your insurance agency then you should start with Facebook, then add a Twitter account second and additional platforms over time.

In the beginning, it is ok to focus solely on setting up your profiles to best reflect your brand. You don’t need to worry about posting content or engaging with folks until you have your brand presence completely optimized and ready.

Below is the complete social media marketing process, right now we are focusing on steps 1 and 2.

Social Media Marketing Process

- Audit your social presence and collaborate with your team to understand your brand and marketing goals

- Analyze your competitors’ social presences and develop a social strategy for your brand

- Implement and manage your brand’s social strategy

- Create and share content and communicate with followers

- Manage all of your social media functions or to train your team on how to do it

- Optimize based on analytical data from your social media campaigns

- Increase social followers, online brand awareness, and targeted web traffic

Once your profiles look nice and are branded according to your strategy, it is time to plan your activity on these platforms and start tackling steps 3 through 7.

Here are the activities you can do to grow your brand’s reach on social.

Social Media Marketing Activities

- As your Brand’s Facebook Page, Like local business and organization pages on Facebook

- Follow local business and organization profiles on Twitter

- Like and comment on posts from all of these local businesses and organizations

- Post helpful content for your clients and prospects

- Post statistics and information as an insurance expert

- Post home improvement and car maintenance tips or retirement planning (Depending on your target)

- Use keywords in #hashtags occasionally, but don’t over do it

- Be personable and as friendly and helpful as possible

- Share pictures and other media of your agency and team

- Share valuable insurance blog posts that you read online

- Write and share your own blog posts on social media

Once you begin these activities, you will start to see more and more notifications for page likes, post shares, and direct messages.

If you are tracking your website traffic, then you should see an increase in traffic as well – coming from your two new channels on Facebook and Twitter.

Insurance companies are generating a substantial amount of leads on social media. According to Property Casualty 360,

“Social marketing is a cost-effective way for lead generation. Of all businesses engaging in social marketing, 45% report that it has decreased their lead generation costs and 24% of them say that their revenue has increased specifically from using social media for this purpose.”

BUT they go onto say,

“Even though 93% of agencies report they have some sort of social marketing effort in place, 64% of them don’t measure the return on the investment”

So, if you are going to take the time and effort to get active on social media and are hoping to generate leads. Make sure you have a tracking system in place to help you analyze and measure the results from your efforts.

Social Media Listening for Insurance Companies

When you aren’t engaging on social media, you can use it to listen to your customers and analyze your competitors.

This is called social media listening and is a great way to keep up with customers and competition.

In addition to liking and following local businesses and organizations, don’t be shy to like and follow competitors, customers, and prospects.

This way you can see updates from their accounts and keep an eye on them and their activity. Watching what your competition does on social will give you great insights for your own marketing.

If you really want to take it a step further, you can pay for an app that would crawl social media platforms for mentions of your brand or other keywords.

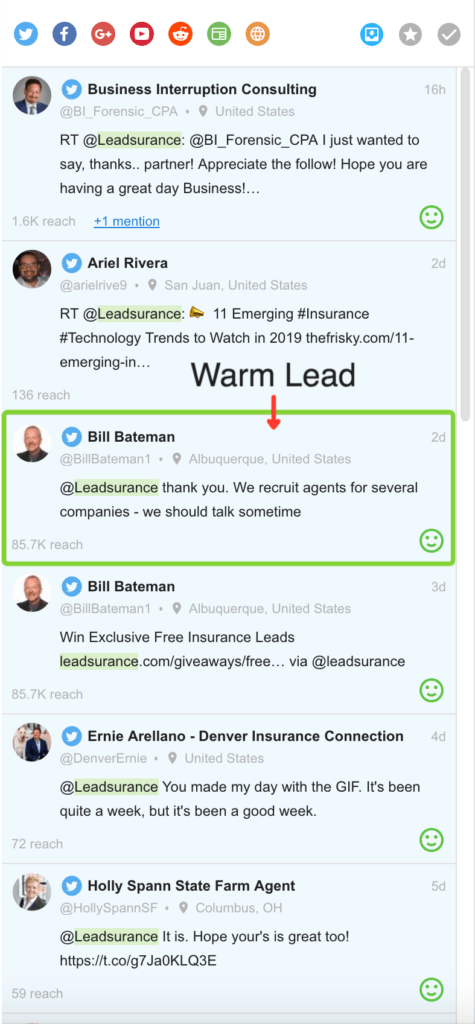

Here at Leadsurance, we monitor all social media and the entire web for mentions of our brand. We get alerts every time someone mentions us anywhere online so that we never miss warm leads, opportunities to engage with prospects, or interactions with our customers.

The app we use creates a feed containing mentions of your brand from everywhere online all in one place with notifications, it looks like this:

Look at that, a few prospects engaging with us and a warm lead.

For agencies with multiple locations or remote employees – apps like these can really help you keep an eye on your agency’s brand and quickly respond to anyone talking about you online.

The guide actually walks you through step by step, with screenshots, on how to use a variety of social platforms to monitor your target audience. It doesn’t require any paid software either although it does share a list of what social listening tools experts are using.

Creating Compelling Content

When it comes to social media marketing in the insurance industry, any agent, broker, or advisor should be aware of some of the most consistently effective strategies.

The next 6 steps, or tips, focus on ways for insurance companies on social media to create better content.

Compelling content should be:

- Relevant to your audience

- Exclusive to your brand

- Well formatted

- Helpful in providing valuable information

So, now that we know what compelling content should be, let’s learn how to make our insurance social media content compelling.

The first thing we will need to do, is get to know our audience.

Study Your Audience and Demographics

When creating compelling content, you must first study your audience and make sure you know some important details about them.

Understanding the following about your audience is important:

- Who – Males, Females, Age Demographic?

- Where – Which states, cities or zip codes do they live in?

- Occupation – What are some of the common jobs they hold?

- Life circumstances – Are they homeowners? How many kids? Vehicles? A motorcycle and boat?

Obviously, you won’t know all of these details about everyone, but the more you can find out about each person in your audience the better.

As an insurance agent marketing on social media, there is a specific group of people that you want to target more than others.

In order for your social and content marketing to have a huge impact, knowing your targeted audience well is an absolute must!

You can’t start creating valuable helpful content for someone if you don’t know their pains and needs.

So start studying your audience as soon as possible and continue to analyze them over time.

Facebook offers free audience insights that can sometimes be helpful.

Use Videos, Images, and a Mix of Media

Next, keep in mind that content doesn’t only revolve around articles, they also include captivating images and video clips.

In fact, according to Hubspot,

“32% of marketers say visual images are the most important form of content for their business, with blogging in second (27%)”

Also, here is a stat from Cisco,

“Cisco projects that global internet traffic from videos will make up 82% of all consumer internet traffic by 2021.”

For many years the marketing strategy online has been pumping out article after article. And this still works.

But, as you can see, there are other mediums to use to get your message out there. Infographics are also a great way of ensuring that your posts get extra attention.

Using visual media, especially when enhanced with powerful AI photo editing, is not just an effective way to capture attention, but also an engaging method to demonstrate to your potential clients how you handle their needs, instead of just writing about it.

So, remember to keep visuals engaging and attention-grabbing with concise messaging that is short, sweet, simple and informative!

Use Data and Share Knowledge

Successful marketers are data-driven. Simply trying to convince people to take action without providing statistics and information that make a compelling argument – won’t work.

As we all know, knowledge goes a really long way. So, keep in mind that you need to continue your education and present yourself as an authority in certain areas such as new financial laws, economic events, and other insurance industry trends among others.

Staying up with these industry events and changes is critical. If you’re looking to attract potential clients through social media content then make sure your content shares knowledge and data that will provide value.

Here are some of the most effective data driven content marketing opportunities to create:

- Charts and Graphs

- Infographics

- Tables and Spreadsheets

- E-books

- Whitepapers

- Outlier case studies

Sharing real data and knowledge will lead to more detailed questions and conversations about your services and insurance policies.

When this small yet effective tactic is done, you provide your clients with real data, and the numbers not only build trust and position you as an authority but the compel your audience to take action.

Adjusting Your Tone

When you do start trying to write content for social media you may hit writer’s block for a number of reasons.

For example, when writing about life insurance, it can be quite a daunting task.

As you already know, the topic of life insurance is a touchy subject and must definitely be handled in a somewhat delicate manner.

However, agents should keep on their toes and maintain a certain type of energy as they speak or convey their message.

Being positive, but definitely not salesy or pushy, is an absolute must. Additionally, take a consultative and informative approach with clients. Simply giving them answers and the information they need to make their decision.

Wait for them to ask you for your opinion before telling them which life insurance policies they should buy.

Remember, you’re working hard to build and nurture a relationship with your clients without being overly technical.

Adapting Content Ideas

Like we just mentioned, actually sitting down and writing content is easier said than done.

Don’t get too discouraged when it comes to writing a post for your blog. You can take a generic article and re-create it with your own unique twist.

Be sure to keep the creativity flowing because the world always has room for your unique version!

You never want to plagiarize or copy paste content. If you want to quote another website then that is perfectly fine, just include a link back to the page you quote.

If you get stuck and are having a hard time creating content, try finding some other content on the topic and adapting it to make it your own.

Tailor Your Words

The point here is to write your content for your specific demographic.

If you’re targeting a specific city be sure that your content fits the local market. And, while you’re at it, be sure that it fits your target audience more than any other!

If you are writing for the senior crowd over age 60, then refrain from using millennial speak like “dude” “extra” “bae” and “turnt”.

Hopefully, that goes without saying.

Sure, there are some cool grandmas out there, but they probably aren’t doing the stanky leg while researching insurance options.

Finding Inspiration

In some cases, inspiration is a bit hard to come by and that’s more than okay!

So, if you’re suffering from a severe case of writer’s block, just take a look at what the competition is doing.

When you get stuck, just look at videos and read blogs to see what others are up to and you can even do some research to collect data from industry publications.

All of these will help you gain new ideas that you can then direct to your target audience through strategic social media marketing.

Time to Spruce up Social Media for Your Insurance Company

Well, folks, those are the 11 proven steps to social media for insurance companies.

Pretty simple right?

I kid, I kid.

I know how daunting things can be in the digital age with technology changing constantly.

So, I would be doing my readers a disservice if I didn’t plug the Leadsurance platform at this point.

Right now, Leadsurance clients are enjoying having custom branded social media and blog content created and shared for them on all of their social media profiles.

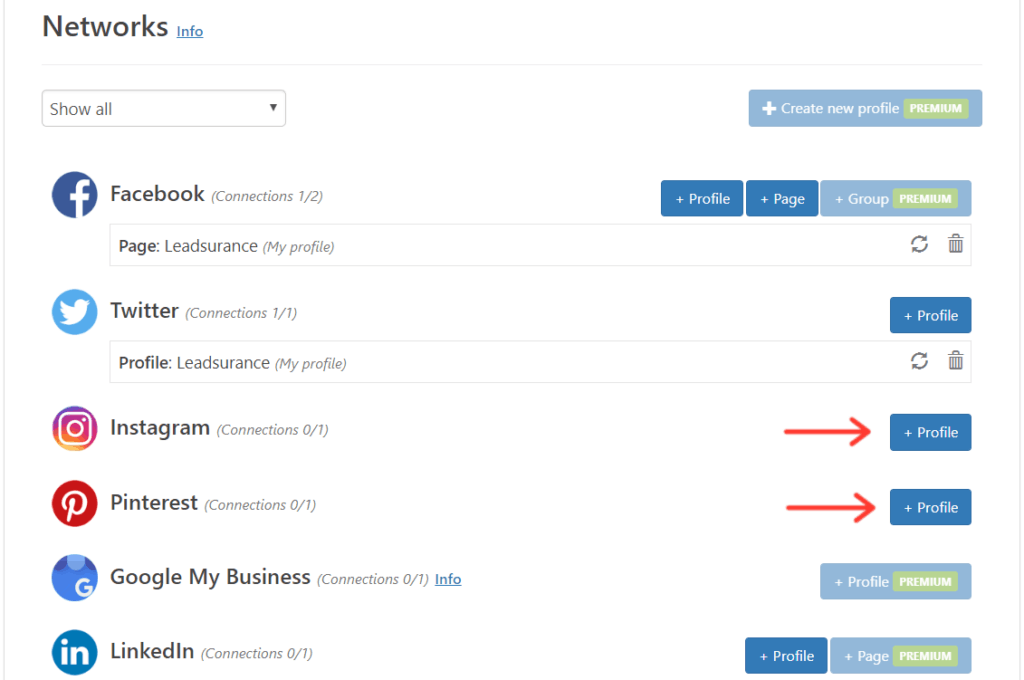

Our clients literally just make a few clicks to connect their social media accounts, like this:

And then we keep their profiles up to date with custom branded, engaging, and educational content. That is right, done-for-you content and automated sharing.

With Leadsurance you won’t spend your precious time trying to stay top of mind and reach new prospects on social media, we will do it for you.

If that sounds like it would be helpful to you, then make sure to get a demo before you leave 😉

You will also get to see how our insurance chatbots assist prospects.

Good luck implementing social media for insurance companies. If you have any questions along the way, just leave any comments or questions in the discussion section below.