When agents hear the words automation and artificial intelligence many times they cringe.

Whether they dislike technology, don’t embrace change, or fear losing their job – it seems many agents aren’t ready to discuss reality.

The reality is, insurance automation is coming to the industry and it is bringing artificial intelligence with it.

Regardless of how you feel about automation and artificial intelligence technology, now is the time to discuss insurance automation for your business.

Insurance Automation Trends

First, let’s take a look at what is happening in the industry and how we are seeing insurance automation come about.

I want to begin by pointing out, that rather than being fearful of these tech changes, insurance agents should be seeking opportunities.

The stronger your tech skills can become and the better digital talent you can bring to your agency, not only will you survive these changes, you will thrive.

Seriously, $13,000,000 Euros were recently seeded for insurance robot “Clark”

To that end, insurance robo advisor Clark, for example, recently completed “Series A” funding of approximately 13 Million Euros. Clark uses algorithms to first analyze its customers’ needs and then automatically propose optimization opportunities.

Source: Deloitte “How robotics and cognitive automation will transform the insurance industry ”

I don’t know about you, but if a robo advisor is worth $13M Euro, then I want one for my business!

If the bot can save insurance agencies time and produce results, then using one is a no brainer.

But it isn’t just robot agents we are talking about, here are some interesting observations from McKinsey & Company:

Carriers should apply technologies such as click-to-call, cobrowsing, and live video chats that allow customers to interact on their own terms.

The second opportunity is in redesigning and automating interactions so that customers don’t wait 30 days for responses or abandon carrier websites because they are outdated or difficult to navigate.

This is absolutely where things are headed in the insurance industry.

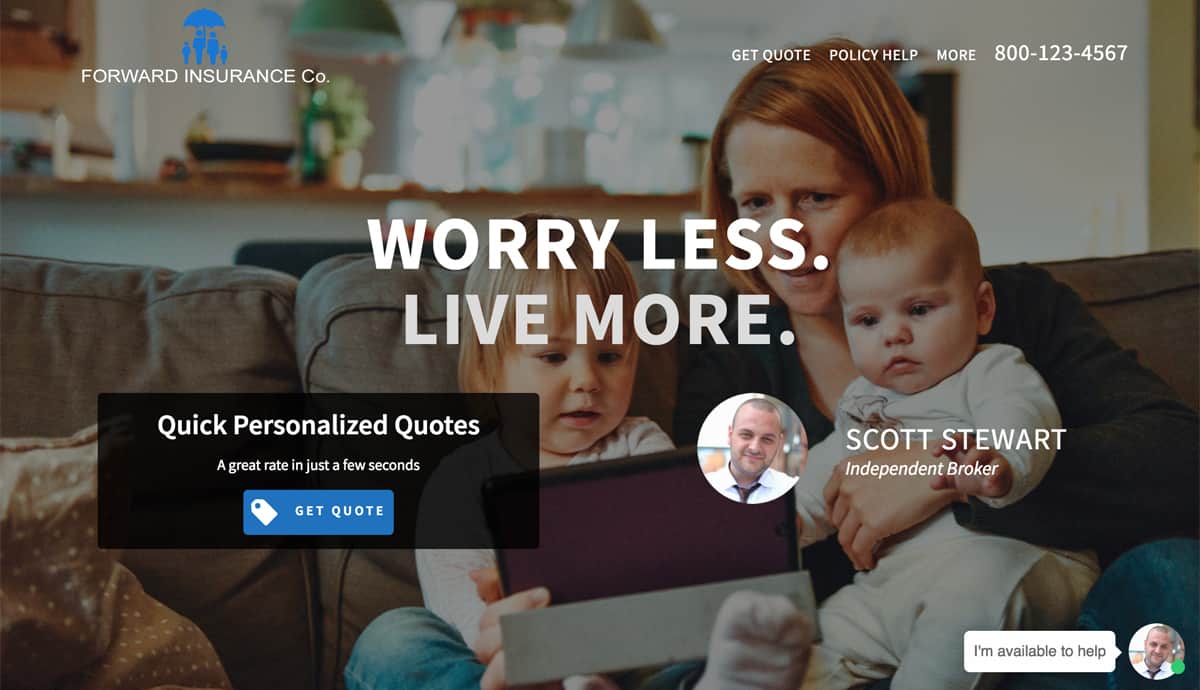

In fact, we are already offering similar solutions to independent agents and agencies to offer support with chatbots on their websites.

Our solution utilizes both artificial intelligence and automation to assist both customers and insurance agents in the process.

Customers want information when they want it and how they want it.

McKinsey & Company also shared these trends:

The insurance industry—traditionally cautious, heavily regulated, and accustomed to incremental change—confronts a radical shift in the age of automation. With the rise of digitization and machine learning, insurance activities are becoming more automatable and the need to attract and retain employees with digital expertise is becoming more critical.

Over the next ten years, up to 25 percent of full-time positions in the insurance industry may be consolidated or replaced.

Look, robots don’t want to take your jobs. They are being designed to work alongside insurance and digital experts to take over repetitive tasks saving you time and money.

If you are paying attention now and working to automate your insurance agency early on, then you can keep up with the automation trend and continue to thrive while competitors are left behind.

Start Automating Your Insurance Agency

Stop fearing inevitable change, insurance automation is coming whether you like it or not.

Start implementing automation into your insurance business now to grow and thrive during these changes in the coming years.

Or, get left behind.

The choice is yours.

Get started automating your insurance agency today with a live demo of the Leadsurance platform.

You will then learn exactly how our artificial chatbots and automated marketing campaigns can generate higher quality leads for a lower cost.

Then maybe you won’t be so turned off by insurance automation after all.

Questions or comments about insurance automation? Let’s discuss them below.