Email marketing for insurance agencies is an essential part of the business.

Off the top of my head, I can think of so many types of email communications for insurance agencies.

- Welcoming new policyholders onboard or subscribers to your newsletter

- Notifying prospects and explaining the next steps when they request a quote

- Communicating policy renewal dates

- Greetings to policyholders during holidays or on birthdays

- Direct email messages sent back and forth with policyholders

- Making announcements regarding your business

- Educating policyholders on new products and services

In this complete guide to email marketing for insurance agencies, you will learn how to grow, engage and convert your leads by implementing a thorough email strategy.

In the insurance industry, generating leads is key. But how do you keep them engaged and nurture them to a sale?

Email marketing simply means communicating with customers and prospects via email.

The biggest difference to social media and other channels is that emails enable a direct way of communicating with your audience. Therefore, it is similar to phone marketing but less intrusive.

The content of these communications can vary and every business is unique.

So, a cohesive strategy will enable you to piece together these elements and create actual value for your leads and eventually win their business.

Why you should focus on email marketing

Although being a relatively old medium, email marketing is still highly relevant. With an average Return on Invest of 38:1, it may be the most lucrative marketing channel. This is particularly true for industries with high customer acquisition costs – as it is the case for insurance.

With the right guidance, you’ll be able to create more engaging emails and turn more leads into customers.

Here are the two main reasons you need to implement email marketing for your insurance agency:

- Staying Top of Mind: If you don’t regularly engage with your audience, chances are you will be forgotten soon. And a competitor might take your spot. Regular contact with your audience not only helps to keep you top of mind and build lasting relationships but also to strengthen your brand through mere exposure. Email marketing is a key component of maintaining lasting customer relationships.

- Nurturing to a Phone Call: Without a doubt, immediate phone contact is often key in the insurance market. However, there will always be potential customers who signed up but are not really up to chat via phone.

- Build an upper-lead-funnel: Not always will people that come to your site through SEO directly want to sign up for insurance. Sometimes, all they come for is certain information – being far from wanting to be called on their phone. Take these barriers by offering to merely sign up for your newsletter in order to receive regular information.

By keeping in touch with prospects and policyholders you can grab their attention at the times in their lives when they need you. Your email strategy can win those back and enhance your relationship with existing customers.

Send Email Marketing Campaigns to 10,000 Contacts

Starting at $99/month you can have an amazing insurance website set up for you and marketing tools to grow it. This includes the ability to create beautiful email newsletters with a drag and drop editor and send campaigns to 10,000 contacts. With analytics reporting to track and measure your results and important KPIs.

Measuring Success with Important KPIs

Measuring success is key for every marketing activity. Time and resources are short and you will want to make sure not to waste them.

Below, you will find the most important KPIs in email marketing, along with some insurance industry benchmarks.

Open Rate:

- Definition: The percentage of email recipients who also opened your mail

- Insurance Industry Benchmark: 21.4%

Click Rate/Click-Through-Rate:

- Definition: The percentage of people who clicked on the link/CTA

- Insurance Industry Benchmark: 2.1%

Click-to-Open-Rate:

- Definition: Out of those people who opened the email, the percentage of people who clicked the link

- Insurance Industry Benchmark: 13.7%

Unsubscription Rate:

- Definition: The percentage of people who unsubscribed after receiving your message

- Insurance Industry Benchmark: 0.3%

Bounce Rate:

- Definition: The percentage of people who received your email. Bounces occur e.g. when using wrong email addresses.

- Insurance Industry Benchmark: 0.7%

Benchmark source: Mailchimp

How to Create Better Emails

This section will go over many different email marketing optimization techniques you can use to create better emails.

What are better emails? Better emails are emails that get more engagement from your audience by getting:

- Higher open rates (email opens by your contacts)

- Higher click-through rates (clicks to your website)

- Higher replies (more email replies from your contacts)

Topical Variety

The variety of potential emails to send out to your audience is vast.

But you’ll want to make sure it is valuable and relevant to them. So it is crucial to understand your subscribers well enough – and only deliver them something of value.

Simultaneously, you won’t want to scare off your audience by only sending out pushy sales-CTAs.

A general rule of thumb is the 80/20 rule:

- 80% of your emails should provide value and deliver interesting insights.

- 20% of your emails should drive action, promoting your insurance and motivating followers to close the deal.

Writing the perfect headline to increase open rates

A mail that no one opens is basically worthless.

Your subject line is arguably the single most important factor to motivate your leads to open your communication.

A few things to keep in mind and try out:

- Keep it short: According to Mailchimp, 28-39 characters are ideal in order to keep click rates high.

- Clearly state what your mail is about.

- Frame your headline as a question.

- Personalize your message.

- Identify yourself: E.g. include your brand name in [brackets].

- Tell the reader what the mail is about.

- Test different subject lines.

- Be careful with ALL CAPS, exclamation marks or emoticons, but definitely try them out.

- Optimize your preview text by specifying your subject line.

- Use numbers.

Sending Schedule/Timing

The time you send out your email marketing campaigns is crucial, as well.

Generally, you’ll want to land in your recipients’ inbox when it’s empty. This is mostly the case in late mornings or early afternoons.

However, depending on your insurance niche, this could differ.

Again, make sure to keep in mind your target customers. You might even be able to segment them according to their current occupation or time zone.

At any rate: Don’t be afraid to test different times and go for those that work best. Let the numbers speak for themselves.

Branding

Depending on the positioning of your insurance agency, you will have a certain CI you’re following.

It is only natural that you want to translate that into your email templates – and that is fine.

However, also do keep in mind that there is a trend towards sending emails free from all branding.

Why? There are two main reasons:

- It helps circumvent Spam filters and increase deliverability.

- It just feels more natural and thus more authentic and relevant.

The best way to figure out your email branding is to send a group of test emails to see which ones perform better.

If you send a few campaigns with branded email templates and compare them to a few other campaigns with non-branded emails then you can see which ones your audience prefers. This is called A/B testing.

Personalization

Every one of your subscribers is different. That’s why mass-mailings are a thing of the past. If you want to deliver value, you have to understand the recipient.

Work with segments. Keep information about your customers. Try to differentiate your message as much as you can.

Possible aspects to base personalization on could be

- Name (usually just first name is fine)

- Demographics (age, gender, job, children)

- Geo-Location (Neighborhood, City, State, or Country)

- Intent (e.g. the page your user signed up on, a type of insurance you know they’re shopping, a certain life event you know they are experiencing, a policy renewal date)

Think of Amazon. They know pretty well about the products you’re interested in, based on your prior shopping behavior.

This enables them to communicate the right recommendations to you and to talk about things you might like.

The better you know your potential customer, the more relevant content you can provide. Names work well to increase attention and a sense of personal relevance.

But in order to provide real value, that’s not enough.

Everybody has an interest in insurance. But the circumstances that concern us at the moment are always different.

Ideally, you’d know if your signup has a dog, owns a business, has children and so on. Obviously, you likely won’t have all this data. But anything you have can make sense to talk about the right insurance with your customers.

One approach to do so could be to segment signups by the blog article they found you with. Maybe they landed on your site through your article on insurance for dog owners? Easy – add them to the respective segment.

Call-to-Action

It can be alluring to promote multiple actions at the same time.

However, it isn’t optimal.

Chances are your mail will at first only be skimmed through. This gives you approximately 8 seconds of focused attention.

Including multiple messages will usually mean that your communication will get lost.

Nothing is more important than having a clear message.

You want your contact to reply or schedule a call on your calendar?

Good, then make the email focus on that specific action.

Therefore, it is generally helpful to apply copywriting formulas such as the AIDA model.

AIDA is an acronym for …

- A – Awareness

- I – Interest

- D – Desire

- A – Action

…and describes different stages your readers go through.

Start with an awareness-driving subject line. Make your subscribers want to find out more. This can transfer to the first 1-2 lines of your mail, as well.

Then, be a bit more precise and create some real interest.

The next step is to create a desire. This is also the stage where you provide valuable information to your readers.

Close your mail with some kind of call-to-action. This doesn’t mean you have to sell anything. Again: Only do this in 20% of your emails at most.

A Call-to-Action in other cases can also be an invitation to try out what you just learned, or to reflect on it.

Topics for Email Marketing for Insurance Agencies

Again, there are many things you could potentially write about. These are a few categories to help you plan your content strategy.

Welcome, Onboarding, and Quote Notifications

This one is pretty straightforward. Once new leads request a quote or submit their information on your website, a proper welcome mail should go to them.

Thank your audience for taking this first step and make them anticipate what’s coming next. You want to keep them engaged since they just requested information from you, this will help keep their attention until you can get them on the phone.

Hopefully, before one of your competitors gets their attention. When people are looking for insurance quotes online, they often shop around so you want to stay in front of them and get them on the phone ASAP.

Keep them engaged, set their expectations, and make sure they are familiar with your insurance service without appearing too pushy.

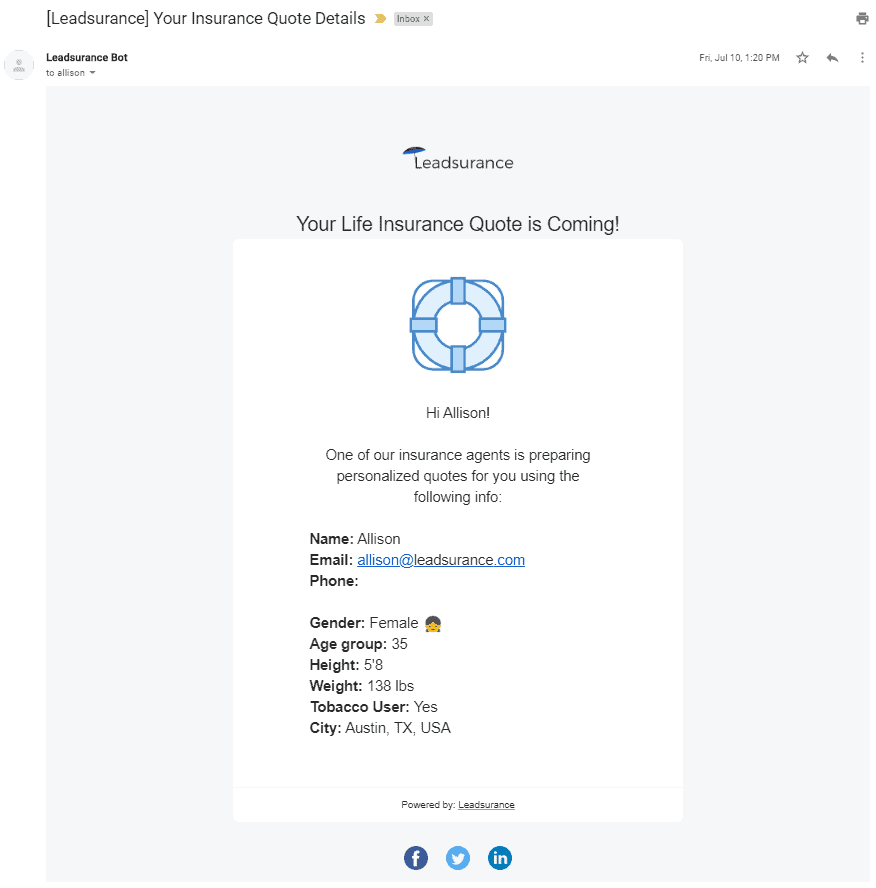

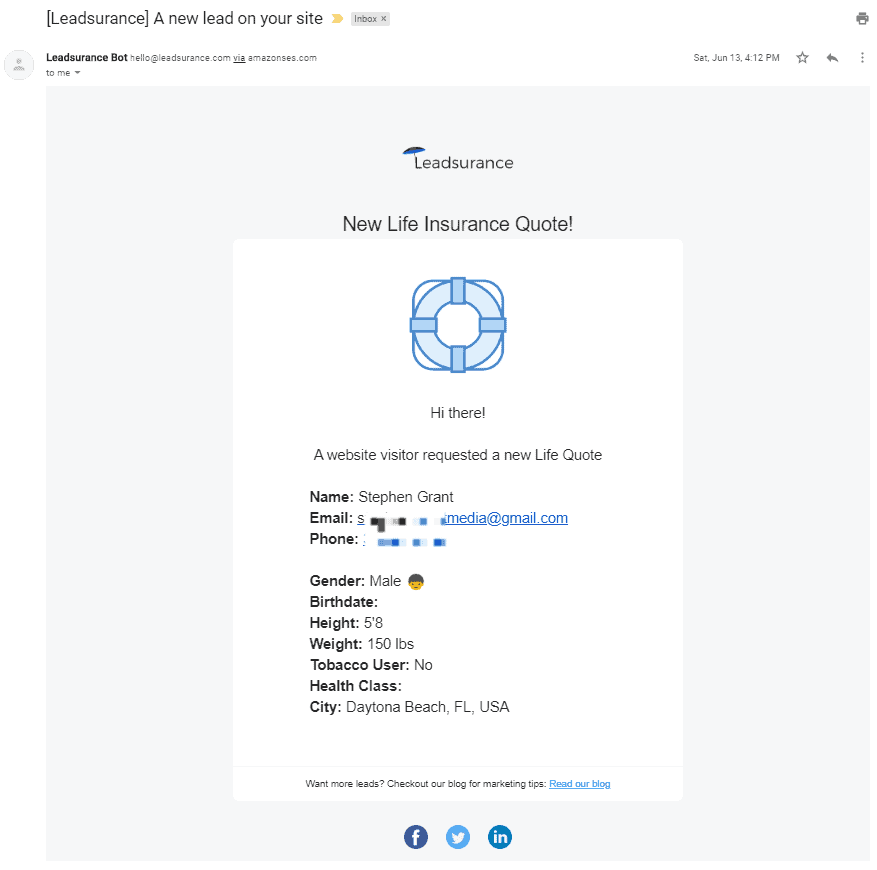

For example, when one of our insurance chatbots gives someone a quote on an insurance website, we send the person an email confirming their interaction with the bot and communicating the next steps.

We also email the insurance agent in real-time notifying him of the new lead with all of their details so that the agent can follow up quickly and efficiently and sell more policies.

Informative Content

First of all, keeping a conversation going often means talking about some form of content. If you have a blog or similar outlet, you want these topics to also reach your customers. Having a cohesive content marketing strategy means creating compelling content to distribute and promote via different channels.

Ask yourself: What are the topics your leads care about?

-

- If you sell mostly home and auto bundled policies, then share content that is useful to homeowners and auto owners. Ways for them to save on insurance, electricity, prepare their homes for the winter, or tips for maintaining their vehicles.

-

- If you sell life insurance and other financial products then talk about the life stages when it is appropriate to assess these products. Help educate people on the benefits and ways to leverage these products.

- If your policyholders are pet owners, then talk about common issues like decreasing appetite, what (healthy) food to give their dog and so on.

So, if you are releasing a new blog article that could be interesting, tell your readers about it.

However, this informative content can also purely take place in the email content itself. This way, you will make sure to lose fewer readers who wouldn’t make the click through to your blog post. Make sure to structure this mail well and make it an easy read.

At Leadsurance, we integrate your blog and your newsletter so that with just a few clicks you can set up an automated newsletter to go out to your contacts sharing your new blog articles.

You can start with the custom branded insurance template that we create for you or one of many attractive generic templates. Then easily swap out the images and text by dragging and dropping content blocks. It is like MailChimp’s editor but for convenience, it is located in the backend of your website and automatically pulls content from your blog. It can even be set on an automated schedule with pre-made templates.

We make it easy and effective!

Announcements

Does your insurance now cover additional benefits? Communicate them.

Did you just sponsor a local event or organization? Share the good news.

Did you launch a new website? A press release and email would be great to let folks know.

Did you recruit new staff? Or re-locate to a new office?

There will be many reasons you should make announcements regarding your business and email can be a great way to communicate them.

Educate

Insurance and related topics can be complex (and sometimes funny like these memes). Generally speaking, insurance is not necessarily the most engaging topic. That’s why many people don’t fully understand their benefits and limits.

Educate your policyholders and new leads.

They will be thankful for it.

And you will sell more policies.

If you want to get more content ideas for your insurance email marketing and other content marketing efforts, check out these 30 insurance content ideas to generate leads.

Automate

Following up with with new leads quickly is important. Time won’t always allow this to occur via phone.

But there are more reasons why you should automate as much as you can.

First of all, it saves time. Once you reach a certain amount of subscribers, it is impossible to keep track of the state of every conversation you had with them and send them the right info at the right time manually. Save time, save effort, and avoid mistakes.

Also, automation allows you to tailor your messaging better to your leads and the current stage of your relationship. In the case of creating newsletter leads, your main goal is to lead subscribers through the purchase funnel.

This is your chance to guide them from awareness to interest and ultimately action.

Questions about email marketing for insurance agencies? Ask them in the comments below