The stock market is a great way to start investing and building wealth, but it can be intimidating. With so many trading platforms to choose from, it can be difficult to decide which one is right for your individual needs.

Robinhood and Webull are two of the most popular stock trading apps available today. They both offer a user-friendly experience with a variety of features, but which one is the best for you?

In this blog post, we will be comparing the two most popular stock trading apps: Robinhood vs Webull. We will look at each platform’s features, including cost, fees, customer service, and educational resources. We will also evaluate the platforms based on their usability, user interface, and customer reviews. Finally, we will discuss the pros and cons of each platform to help you decide which one best fits your needs.

Right now you can get thousands of dollars of free stock just for signing up with Webull.

Alternatively, Robinhood is offering up to $200 of free stocks for signing up.

Whether you’re just starting out in the stock market or are a seasoned veteran, this post will provide you with the information you need to make an informed decision. In this in-depth comparison, we’ll explore the key differences between these two apps and which is the best for you. Let’s dive into a complete comparison of these two popular stock trading apps.

What is Robinhood?

Robinhood is a financial services company that provides stocks, options, ETF’s, and now cryptocurrency. Launched in 2013 with a mission to democratize the financial system, Robinhood has grown to be worth over $5 billion with millions of customers across America.

Robinhood remains a free stock trading app since it was created in 2013. It is currently available on iOS and Android platforms. Robinhood is a mobile-only app that provides investors with an easy way to trade stocks. It offers a brokerage account for free, but you can also purchase stock without a fee.

Robinhood has a risk management system that is designed to automatically buy and sell the stock when a user reaches their risk limits. Robinhood uses bank deposits as its primary source of funding. These deposits are insured by the FDIC up to $250,000 per account holder. In November 2017, Robinhood announced that it would be expanding its investor base by allowing people to invest with credit cards in addition to bank deposits.

Robinhood offers a user-friendly experience with a variety of features, such as real-time stock updates and charting. Robinhood is highly rated on the iOS app store with over 4 million users.

What is Robinhood Gold?

Robinhood Gold is a paid subscription service that costs $5 per month. The service offers users access to a wide range of financial products and services, including commission-free stock trades, access to margin and borrowing products, and a suite of analytics tools. The service is available in the United States, Canada, and the United Kingdom.

Robinhood Gold is a high-end service for customers looking for advanced stock trading tools. Features include:

- 4% interest on your cash balance with cash sweep

- Higher Limits on Instant Deposits

- Research from Morningstar Level II market data from Nasdaq

- Margin rate of only 7%

You can try Gold for free for the first 30 days. You’ll be charged $5 a month after the trial ends but will also have access to margin investing (7% yearly interest on any amount you borrow over $1,000).

What is Webull?

Webull is a stock trading app that was created in 2015. It is currently available on iOS and Android platforms and is accessible on a desktop device from most major web browsers such as Safari and Chrome. Webull is a stock and cryptocurrency trading platform that offers a user-friendly experience with features such as order management, customizable alerts, and support for multiple accounts. Webull offers a more advanced platform with features such as order management, customizable alerts, and support for multiple accounts.

Comparing Robinhood to Webull

The user experience on Robinhood is much more intuitive, or simple than on Webull which is more advanced. On the website, you can view your investments, account balance, and transactions, you can even watch your portfolio grow with a live feed. On the app, you can see everything in real time including stock prices, news stories, and market trends.

Webull is more advanced than Robinhood with features like support for multiple accounts, customizable alerts, and order management. Robinhood offers fewer features such as real-time updates and charting.

Both apps offer access to similar types of investment opportunities. Webull’s layout might be easier to navigate than Robinhood’s as it has a list of all its investments on one page. It also allows you to filter stocks by company name or industry type for quicker navigation.

Robinhood doesn’t offer the same level of trading options that Webull does (such as alerts). However, it does allow you to customize your own alert style using different colors and icons from different categories such as market change or purchase price increase/decrease.

Both apps share the same ease of use and similar offerings such as information about investments that are trending in the market right now or companies that have recently filed for an initial public offering (IPO).

Trading Costs

When comparing Robinhood vs Webull, one of the most important factors is trading costs. Robinhood offers $0 commission trades, which makes them an attractive option for those looking to save money on trading costs. However, Robinhood does charge a fee for certain services, such as margin trading, and the stock market can be volatile at times. Webull, on the other hand, offers commission-free trades as well, but does not charge for margin trading. Additionally, Webull offers added features such as advanced charting and technical analysis tools, which can help traders make more informed decisions.

Asset Types Available

When it comes to the asset types available, Robinhood and Webull both offer a wide variety of options. Robinhood provides stocks, options, ETFs, and cryptocurrency trading. Webull offers stocks, ETFs, options, crypto, and mutual funds. Both also offer margin trading for those who wish to invest with borrowed money. Webull offers a larger selection of mutual funds, but Robinhood has a much larger selection of cryptocurrency options. Both platforms also offer a cash management feature, which allows investors to earn interest on their deposits.

Research and Analysis Tools

Robinhood and Webull both offer a range of research and analysis tools to help traders make more informed decisions. These tools include news and analytics, real-time quotes, options chains, and more. Robinhood’s tools are quite comprehensive, with its options chains allowing traders to view current and historical options prices, view IV and HV for options, and research stock splits and dividends. Webull also offers comprehensive research tools, including a comprehensive charting platform, screeners, and a financial calendar. Both platforms also offer stock and ETF news, as well as analyst ratings from multiple sources.

Mobile App Functionality

When it comes to mobile app functionality, Robinhood and Webull are quite similar. Both apps are available for download on both Apple and Android devices and provide an intuitive and user-friendly interface. Both apps offer real-time market data, an array of analytics tools, and customizable watchlists. The key difference between the two apps is that Robinhood does not allow for advanced trading, such as options and margins. Webull, on the other hand, offers these features in addition to their standard features. Additionally, Webull provides more educational material, such as webinars and tutorials, than Robinhood does.

Account Types

Robinhood and Webull both offer a range of account types, making them appealing to traders of all levels. Robinhood boasts three types of accounts: Instant, Gold, and Cash Management. Instant is the basic account that allows you to buy and sell stocks without any minimums or fees. Gold is a premium account that allows you to access extra features, like margin trading and extended hours trading. Finally, Cash Management is a checking account that earns you interest on your cash balance.

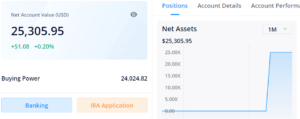

Webull also offers three account types: Standard, Advanced, and Margin. Standard is the basic account that allows you to buy and sell stocks without any minimums or fees. Advanced gives you access to real-time market data, margin trading, and extended hours trading. Finally, the Margin account gives you access to margin trading and additional features, such as the option to borrow up to 50% of your account value.

Minimum Deposits

When it comes to minimum deposits, Robinhood and Webull offer two of the lowest amounts in the industry. Robinhood doesn’t require any minimum deposit when you open an account, while Webull requires $0 for a cash account and $100 for a margin account. Both platforms also offer zero-fee trading, so you don’t need to worry about having to make any minimum deposits in order to trade. Neither platform has a minimum account balance or minimum investment requirement.

Commission Free Trades

When it comes to commission-free trading, both Robinhood and Webull offer customers the ability to trade stocks and ETFs without paying a commission. The only exception is with the purchase of fractional shares, where Robinhood charges a fee. Both apps offer a variety of charting tools and real-time streaming of market data, and in the case of Webull, extended-hours trading is available. In addition, Webull customers can borrow funds for day trading, which can be a useful feature for experienced traders. The key difference between the two apps is Robinhood’s social features, which allow you to follow the trades of other investors and copy their portfolios. Webull does not offer any such features at this time.

Not only do both platforms offer $0 trading activity fees but neither platform charges any maintenance fees either.

Customer Support Services

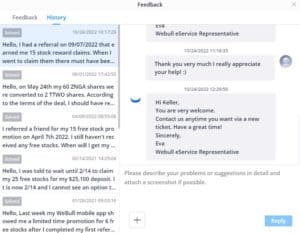

When it comes to customer support services, Robinhood and Webull both offer a variety of options. Robinhood has a customer support center, which allows users to contact customer service representatives through a web form, email address, or telephone number. Webull’s customer support services are equally comprehensive. The app provides a live chat feature, which enables users to get assistance in real time. Additionally, Webull offers extensive knowledgebase, which contains helpful articles and tutorials. Both apps also offer customer support through social media channels. Webull even offers customer support within the app where you can directly message the support team and get answers quickly.

Advanced Features

Robinhood offers investors advanced features such as margin trading, margin calls, and stop losses. These features give investors more control and flexibility when trading stocks. Additionally, Robinhood offers a mobile app that makes trading easy and convenient. Traditionally, Robinhood has been better for beginners and offers a more simple platform however recently they have rolled out advanced charts to compete with Webull’s advanced features.

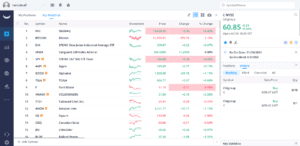

Webull is known for its advanced trading tools and offers a variety of advanced features that make creating and managing stock trading easier. These features include more trading options and advanced reporting features. Additionally, Webull offers a variety of tools and features that can help users achieve their investment goals. Webull offers advanced features for both beginners and experienced traders. For example, Webulls’ dashboard aggregates in-depth market data for all types of equities and bonds. This data can be viewed at a glance, which simplifies viewing specific information about the market without having to toggle between different screens while also offering detailed candlestick charts. Additionally, Webull offers broker SWIPE notifications that allow users to receive personalized alerts from the various online brokers they trade with as well as extended trading hours.

Margin Rates

Robinhood Financial charges a standard margin interest rate of 11% and a margin interest rate of 7% for customers who subscribe to Robinhood Gold.

The average margin interest rate for Webull customers is 6.17%. In addition, Webull only charges margin accounts interest for leveraged positions held overnight.

As you can see, margin rates are lower with Webull so if you are a margin trader who plans to trade on a margin then you are better off using Webull.

Options Trading

Webull options trading is a trading platform that allows users to trade options contracts online. The platform offers a variety of options contracts, including call and put options. Webull also offers a variety of trading tools, including a built-in order management system, a chat room, and a user forum.

Robinhood is a popular options trading app that allows users to buy and sell options easily and with no commission. The app also offers a variety of other features, such as real-time stock tracking and price alerts.

There are a few key differences between Robinhood and Webull options trading platforms. Robinhood is a free platform with no commissions, while Webull is also free mostly sometimes it charges a flat fee of 0.55% cents per options contract. Additionally, Robinhood only offers options on stocks and ETFs, while Webull offers options on stocks, ETFs, and commodities. Finally, Robinhood only offers a limited number of options contracts, while Webull offers a much greater range of options contracts.

Paper Trading

Paper trading is a method of trading stocks and other securities that involves the purchase and sale of securities through a paper account, rather than through an account with a broker. This means you can practice buying and selling stocks without using any money. Paper trading allows investors to test their ideas before actually buying or selling a security. Additionally, paper trading can be used as a way to gain exposure to a particular security or market sector without actually investing any money.

One big advantage of both Robinhood and Webull over other brokerages is that they offer the option to paper trade stocks. This means that you can buy a stock, hold on to it for a short while, and then sell it before it goes up or down in price. This can be a great way to test out a stock before actually buying it. Additionally, Robinhood has a very user-friendly platform, making it very easy to get started.

Crypto Trading

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Bitcoin is not the only cryptocurrency available, though. There are also Bitcoin Cash, Litecoin, Ethereum, and many others. Crypto trading is the process of buying and selling cryptocurrencies. Crypto exchanges are websites where you can buy and sell cryptocurrencies. You can also use crypto trading to hedge against potential losses in your other investments.

At first, trading crypto was complicated but now trading cryptocurrencies has never been easier. Robinhood has a user-friendly interface, zero trading fees, and instant transfers. They are also adding new currencies and stocks every month and have plans to expand internationally soon. You can currently trade Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Ethereum Classic. Users can track the price of other cryptocurrencies like Ripple, Bitcoin Gold, etc on the app but cannot trade it. Please note that Robinhood Crypto will not offer trading for every single cryptocurrency.

Trading cryptocurrency with Webull is as easy as signing up and transferring money. You can trade BTC, ETH, LTC or BCH. You can start trading crypto with Webull by using a bank transfer or wire transfer. We like that it is available in a variety of currencies and countries, that there are no hidden fees or service charges, and that you can instantly buy cryptocurrencies with your PayPal balance. The downside to this platform is that the interface is not as simple or user-friendly for newcomers to digital currency trading. However, it offers more data and reporting for advanced crypto traders or anyone familiar with trading cryptocurrency.

Which Stock Trading App is Best for You?

If you’re going to go with a new investment platform or stock trading app, you’ll want to choose one that’s user-friendly and easy to use. Robinhood offers features such as real-time updates, charting, and order management. Webull offers customizable alerts and support for multiple accounts. However, Webull has a more advanced platform with features like order management, customizable alerts, and support for multiple accounts.

If you are trying to decide which of these broker platforms is best for you, you need to determine if you are a passive investor or an active trader and whether or not you are a beginner or advanced investor. When choosing between Robinhood vs Webull it depends on what type of trader you are and what type of features you need.

Active Traders

Active traders are those who use stock trading apps to trade stocks and cryptocurrencies daily. They are constantly on the lookout for new opportunities to make money and are willing to take on more risk in order to make a profit. Active traders are often able to make more money on the stock market than those who only invest passively.

Active traders are able to take advantage of fluctuations in the market and make profitable trades faster than those who do not trade actively. This can lead to increased profits and a greater overall return on investment. Additionally, active traders are also more likely to be able to predict how the market will move and are better equipped to take advantage of opportunities when they arise.

There are many benefits to being an active trader, but the primary drawback is the time commitment. Active traders have to stay current with the market, which means they have to be on their computers or smartphone from morning to evening. Passive traders, on the other hand, can invest in stocks and then only check in every few months. Active traders also need a larger investment to get started and a more diverse portfolio.

Active traders using Robinhood enjoy several benefits over those who do not. First and foremost, active traders on Robinhood are able to trade quickly and easily, without having to wait for orders to fill. This means that they are able to make more informed decisions about their investments, which leads to improved profitability. Additionally, active traders on Robinhood are also able to take advantage of features like margin trading, which gives them the ability to increase their return on investment even further. Finally, active traders on Robinhood are able to easily share their investment strategies with others, which can lead to even greater profits.

There are many benefits to using Webull as an active trader. Webull is a cloud-based stock trading platform that makes it easy for businesses to manage their crypto and stock trading operations. The most popular features include a free stock trading app for employees on the go; a centralized cash management system with support for all major cryptocurrency and traditional fiat currencies; online and offline investment services, including futures, options, ETFs, and shares in addition to stocks; the ability to trade stocks, cryptocurrencies and other assets at market value pricing. Additionally, Webull offers a number of features that make it easy to stay up-to-date on the latest market news and get ahead of the competition.

Advanced Traders

Advanced traders often use Robinhood to trade stocks and ETFs. This is because Robinhood offers a low-cost way to access these markets. Additionally, Robinhood offers a variety of features that allow traders to track their positions, perform trades quickly, and receive real-time notifications about market movements.

Advanced traders use Webull to manage their trading strategies. They can monitor their trading activity and performance in real-time, and make adjustments as necessary. Webull also provides access to a wide range of trading tools and resources, including market data, technical analysis, and trading platforms on both mobile and desktop devices.

So who is the best app for you? If you’re new to investing or just looking for an all-around good app that’s easy-to-use with seamless navigation, Robinhood is the way to go. The simplicity of this app will make it a great choice if you’re new to investing or just don’t have time to read a lot of guides or do research on the market. But if you want something more advanced with bells and whistles like Webull provides, then this might be the app for you.

Conclusion

All in all, Robinhood and Webull are two of the most popular stock trading apps on the market both offering a great trading experience. Both of these apps have their pros and cons, but overall both of them offer a great way to invest in the stock market and help you reach your financial goals. Both of them offer a low barrier to entry, low fees and commissions, and a wide variety of investment options.

As a beginner investor, it can be hard to decide which platform is best for you, so it is important to do your research and decide which one fits your investment needs. Hopefully, after comparing Robinhood vs Webull in this article you can determine which of these investing platforms is best for you.