Regardless of whether you are an amateur, professional, or expert insurance marketer, working without a plan won’t get you the best results.

The main reason why many marketers fail in their marketing is that they do not plan properly leaving them inconsistent in their efforts.

If you want to sell more insurance policies then you need to be consistent with your marketing plan.

In the words of Dwayne “The Rock” Johnson,

“Success isn’t always about greatness. It’s about consistency. Consistent hard work leads to success. Greatness will come.”

It should go without saying that the Rock is a famous American-Canadian actor, producer, investor, retired professional wrestler, and former American football and Canadian football player. He has played major roles in many Hollywood movies acting in over 61 films. Consistency is not just something he preaches, he practices it too.

With any career or business goal, all you need to do is stick to it and stay consistent while measuring your results, your insurance marketing plan is no different.

If you want to create an insurance agent marketing plan and don’t know what to do, then this article is for you.

We have compiled the best ways insurance agents can properly craft their marketing checklist to achieve the best results.

Let’s dive in.

Research Marketing Channels & Strategies

When creating your insurance marketing plan, the most important thing you need to do is research.

If you do not conduct proper research about your marketing channels and your target prospects, then you will not get good results and end up wasting marketing spend.

Research is one of the most important foundations in creating good insurance agent marketing plans.

Thorough research will help you plan your marketing budget, plan your strategy, set goals for leads and sales, and conduct in-depth research to know which channels you are going to use to reach prospects.

Another great thing about research is that you may be able to predict future outcomes. When you conduct the proper research, you will know based on data the best places to target. If you do not research, you will end up wasting resources making decisions based on your opinion.

In marketing, we always say “data over opinions”. When marketers say this we are saying to never make a marketing decision based on what you think will work. You should always research and analyze data to determine what works in marketing.

So, as a marketing professional placed in charge of executing a marketing plan, never forget the importance of research. This is the building block for all of your marketing efforts and skipping this step is going to drastically reduce your marketing plan’s results.

Here are some areas you can perform marketing research:

- Google Keyword research

- Facebook Advertising

- Email marketing research

- Social Media marketing

- Advertising channels

Set SMART Goals for Leads and Sales

For you to be able to see your marketing grow, you must be able to sit down and set reasonable goals that will help you excel in the long run. To achieve the best results you have to make SMART decisions.

You want to make decisions that are Specific, Measurable, Achievable, Results-focused, and Time-bound. When you make goals like this, it will be easier to reach them and see a greater impact on your business.

The main reason why you need to set attainable goals is simple. When you set goals in your insurance marketing plan, there is always a higher chance that you and your team will fulfill them faster than you set out to.

Goals are important if you want to work faster and get better results in the shortest time possible. You will attain your business aim when you set goals, especially as an insurance marketer.

There are certain areas of your pitch that you want to set goals for. Set goals for your cross-selling, for the production and retention, and the acquisition of prospects. When goals are set for all the important parts of your plan, implementation will be much easier.

Get Advice from Experts in the Field

There are a lot of things you can learn from experts because there is no marketing plan for insurance agents that most of the experts have not done before.

For example, if you are planning to market in a specific channel or to pitch to a specific company, there is a high chance that one of the experts must have tried it before.

If they are willing to tell you, ask them about their opinion on your marketing plan. You will gain really valuable insight from their experience that will save you time and money and help you get better results faster.

The main reason why I say this is simple; by consulting professionals you will save yourself a lot of time and energy that could have been wasted otherwise on your own trial and error. You might as well leverage their experience if they are willing to share it.

In the insurance marketing world, you must learn from the experience of others.

If there is a fruitful marketing channel, then you will find the experts using it. The experts and those before you will show you how you can develop your own successful marketing plan.

Create a Marketing Budget

There is no way you can create a proper insurance marketing plan as an insurance agent without setting your budget. The financial part of your plan is the fuel that drives the entire marketing execution.

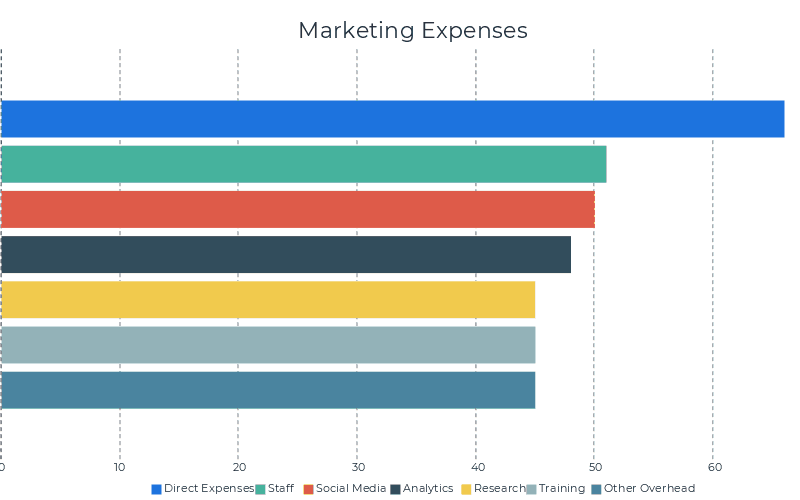

45% – 66% of insurance companies report incurring the following marketing expenses:

- 66% Direct Expenses of Marketing (advertising, trade promotions, and direct marketing)

- 51% Marketing Employees

- 50% Social Media Marketing Costs

- 48% Marketing Analytics Subscriptions and Fees

- 45% Marketing Research Expenses

- 45% Marketing Training Costs

- 45% Other Overhead Costs

This chart data comes from our post on how much insurance companies spend on marketing.

When you are creating your plan, ensure that the financials are included adequately for all of the items in your insurance marketing plan template.

These financials include the fixed costs, the variable costs, and the monthly operating costs. Plan for budget surpluses and how you will use these funds.

Apart from the research, this is one of the most important parts of the insurance marketing plan. This is because no process can continue when the finances are not available.

When you are going for a sales pitch, you must ensure that all financial issues are well sorted out. Do not plan anything with significant debts or it could come back to hurt you in the long run. A mistake that many marketing teams make is overspending early on and running out of marketing budget.

Remember, marketing is a marathon, not a sprint, and staying consistent over time is better than spending too much on marketing in a short period.

Do not put yourself in a bad financial position or your marketing results will suffer, make sure to create a marketing budget and stick to it.

Recruit Agents to Scale Marketing Plans

When it comes to your marketing plan you will want to recruit insurance agents as well as marketing professionals that can help you with different areas of your marketing strategy.

Nothing makes an insurance marketing plan executed easier and faster than good teammates. When you have the right people on your team, everything about your sales processes goes smoothly.

When you are choosing the members of your team, you need to choose people to have unique capabilities. When you select someone good in an area, you are required to select another person in a different area. Why do we suggest this? It is simple. When you are on a good team everything will go smoothly.

You may not have a team to work with, but we suggest that you build one. This is because there is a high chance of making insurance sales with a team then making these sales alone. When you are alone and you approach someone, chances are you will not see that deal through except you are a top-rated expert.

Your team has to be the best. Full of energy and character, ready to execute the tasks in the planning in the best way possible. IF you select the best team, you will influence your sales even faster.

Work on the Quality of Your Resource Materials

Your resource materials are the materials that turn your potential sales into customers. So, as an insurance agency, you must ensure that your insurance marketing content is the best. How can do you do this? By making sure that your content and or resource materials are the best.

What do I mean by content or resource material?

The first one is the presentation slide. You might decide to use a slide for illustration, which is a great option. When you prepare a well-detailed presentation, it will capture the mind of your audience effectively.

Even if you decide not to use a presentation slide, you can choose to use a printed brochure. When you are printing this brochure, you must ensure that it is properly designed and tailors to capture the attention of your prospects. If it does not capture their attention, then you may not have done a great job.

When you are preparing your resource material, ask yourself if you were the one pitching, what you would like to see that would capture tour readers’ attention. When you have solved this, then you are good to go.

Content also consists of the copy on your website and in your social media and email marketing messages. Think about how you can not only better get prospect’s attention with this content but also how you can better educate them on the value of your products.

Improving your content and resource materials will improve your marketing results leading to more policies sold.

Rehearsal and Preparation

This is one of the most important parts of the entire planning process. However, it is the one that is often overlooked. When you plan effectively, you will give the best and perfect presentation that no person has seen or heard of before.

When you have fully prepared your presentation you should rehearse as much as you can.

How will you do this? This is very simple. What you need to do is to gather your team, set out specific days in the week, and practice your pitch.

Deliberate within yourselves ways you can improve the pitch. Continue fine-tuning the presentation as you get feedback from clients as well.

As an insurance agent marketer, you must ensure that before you go out on sales you have all agreed on what to say. When you are pitching your products and services, it will look very bad when you and your team are not working in unity.

Practicing is the main thing you need to do here. When you and your team practice consistently you can develop a very effective and natural pitch. This is important because you will need to be selling a lot to be successful.

Work with a Good Referral Program

One of the things you are supposed to know is that your customers are the best referral sources you can ever have in business.

Having existing clients leave online reviews for your agency can turn into referrals but you can also directly ask your existing clients for referrals and offer to reward them.

So, if you are in insurance sales, getting referrals from your existing clients could be the best strategy for you to start with your marketing plan.

A referral program is one that when customers bring in another customer, they are rewarded with something. This is one of the best ways to make more sales because you’d get to involve other people.

Here are some examples of ways to reward your clients for referrals:

- Gift cards to Amazon or local businesses

- Discounts

- Cash

- Free consultations, services, or policy reviews

There are many benefits to implementing referral programs. The referee maybe your former clients that have good things to say about your company. In this case, you are using other people’s networks to grow your insurance agency.

This is one of the best decisions you can ever make for growth. Simply because you do not have to spend your time on the marketing or outreach, your customers do it for you. You leverage the existing network of other people.

Great companies all around the world use referral programs to attract a lot of customers and great insurance companies should too.

When you create a program like this you will see compounding results as you grow your client base over time and have access to more and more referrals through their ever-growing networks.

Always Conduct Customer Surveys

As an insurance marketer, your plan will not be complete until you accept others’ feedback and work it into your marketing plan.

Collecting feedback is one of the best decisions you can make for your business. While creating your plan, send out surveys asking people about your service, the insurance coverage they received and their feedback about all of it.

This will be a good way to gather the right information for yourself on how to continue to improve your marketing plan.

The process of conducting customer surveys is also a good means of research, just like I said in the first point.

This is good because you get to hear real opinions from your prospects that will make a big impact on your sales conversions. If you decide not to conduct surveys before going out to pitch then you will not be able to get the best information possible to lead to more sales.

As an insurance marketer, you need to be smart about your processes. Instead of you guessing about what is hindering them, why don’t you get real feedback on them?

Adding customer surveys to your marketing plan will help you continue to improve it and get better results over time.

Never Forget the Power of Social Media

Social media is a phenomenon that has come to stay. The presence of social media has improved people’s lives and businesses by making it easier for them to connect.

As an insurance agent, you must use social media effectively. When properly utilized, it can be an important part of your marketing plan to help you sell more policies.

The first thing you could do is to use Facebook ads. They are the best when you are trying to reach your ideal audience. Imagine a scenario where you are trying to sell health insurance to a man over 40 years of age.

Instead of looking for him physically, you can easily target him online. It is one of the most seamless, safest, fastest, and most reliable means of reaching your audience.

This is just one example of insurance advertising targeting that you can do online with social media platforms.

To help you get started with social media marketing you can use these free social media posts and every now in then you may want to share something humorous with one of our insurance memes.

Final Words

Going in for a good sales pitch as an insurance agent requires a lot of planning and taking the necessary steps. When you have a good plan backed up with the necessary actions, you will always get the best results.

We hope you will use this info and create the best insurance marketing plan you can execute to get new clients.

Taking the time to research marketing channels, set SMART goals, creating a marketing budget, scaling your marketing team and staying consistent with your marketing plan will lead to positive results for your insurance agency.

Make sure to implement a client referral program, collect client feedback and always continue to improve your marketing processes for the best results.

We also wrote these 15 insurance sales tips that will help you to manage insurance leads and sell more policies.