Creating a Facebook ad can be an intimidating task.

- What should your ad look like?

- Who should you target?

- Are the people who see your ad even looking for insurance?

- Should you boost your life insurance posts?

Even worse, what if you spend tons of money on these ads and generate no leads?

Unfortunately, the fact that many people use Facebook for social networking means that the ads need to be even more attention-grabbing than, for example, ads placed in Google.

This doesn’t mean it’s impossible – many businesses are profiting from Facebook ads, including insurance companies.

It just means that there are some additional details that you need to keep in mind when running your campaign.

We have published another guide to life insurance advertising and in today’s article, I’ll address all of your Facebook advertising concerns and go over some best practices for creating better Facebook ads for life insurance agents.

Let’s dive in.

Have captivating visuals

When you make a Facebook ad, you aren’t just competing with other advertisers – you’re competing with every other post on your target audience’s news feed.

Even if your life insurance policy really is the perfect fit for the people seeing your ad, you need to convince them to actually click the ad before they’re ever going to know that.

Because of this, you need to create something that stands out.

When choosing visuals, make sure you choose something that’s reflective of your brand and, above all, that results in a high click-thru rate.

Depending on your goals, a video may be a better option than an image for your ad. If you’re using a video in your ad, make sure it draws their attention.

- Avoid blue and white – These are the colors of Facebook’s website, and using the same ones will cause people to easily skip over your ad. Instead, choose an eye-catching color that contrasts the Facebook layout.

- Include a value proposition – Facebook does have text limits for image-based ads, but you can make use of that text to draw attention by using words like “free”, or use words that hint at your pricing and attract people who are ready to buy, Try using these words.

- Include a face – Faces tend to get more clicks everywhere online, so try to find an image for your ad that includes one. When choosing a face, find one that represents the age and gender of your target audience.

Now you are one step closer to being an expert at Facebook ads for life insurance agents.

When you are a Leadsurance customer, we will do graphic design for you, or you can hire a graphic design service.

Know your audience

The options when it comes to targeting your ads on Facebook are seemingly endless, so it’s important to know whom you’re trying to get your ad in front of.

When selling life insurance, you can target your ads by age, gender, and location, but there are also more detailed targeting options available to you.

For example, if you’re targeting high-income, educated users, Facebook even lets you segment by users who have college degrees or make, for example, over $100k annually.

You can even target your ads by relationship driven events, such as if someone is newly engaged or married.

This might be a good opportunity to draw interest for a life insurance policy since their mind is likely to be on starting a family and providing that family with security.

- Age – If you have an existing set of customers, set up your targeting to be within their age range.

- Gender – To start with, I’d target both male and female, but see which one is more responsive to your ad and adapt accordingly.

- Income – You want to make sure the audience that sees your ads will be able to afford what you’re offering.

- Life events – Newly married individuals might have family concerns that result in a higher perceived need for life insurance.

It may be necessary to run separate ad campaigns to different sets of customers.

The ad you use to target 18-24 year-old males won’t be the same ad that works when targeting 35-45 year old females.

Identify the need first, sell second

One of the more difficult parts of running a Facebook ad is identifying the need for life insurance among their users.

Since people are on Facebook for social reasons (or memes) and not to shop for life insurance, it might be a good idea to run two different ads.

Here is how to identify the need first and then sell second using two ads:

- The first ad should share a helpful piece of content that determines your audience’s interests in life insurance.

- The second ad should retarget these users to convert them into a lead.

Facebook has targeting options available that let you run an ad to an audience based on previous interactions with a video.

With this, you can share a helpful video featuring helpful information about life insurance, such as how to choose a policy, 5 reasons life insurance is necessary, etc.

Then retarget the audience that viewed at least 10 seconds of the video with another ad aimed at capturing their information.

This is a strategy I’ve used in the past in a number of industries to increase overall ROI.

A/B test your ad

A/B testing is the process of running two or more ads at the same time to see which ones perform better.

Often times, the differences between these ads are small and contain the same or similar messaging. For example, the differences between ads may just be in the color.

On Facebook, you have multiple A/B testing options. You can test the visual elements by creating two banner ads and seeing which performs better.

You can also test between different ad types.

Maybe driving traffic to a landing page on your website doesn’t work as well as using Facebook’s on-site Lead Ad forms.

At any given time, run at least two ads. Whatever the best performing one is, try and create something that performs even better.

You can also tweak your website’s landing page design based on your analysis.

- Your call to action – Try different buttons. Facebook has a large selection available.

- Your image – Try images that have different primary colors, but avoid blue and white, since these are the main colors of Facebook’s interface and won’t stand out.

- Your messaging – The wording of your ad has a big impact on its performance. Asking for comments and shares can boost engagement, which can result in more organic reach.

Offer instant quotes

In today’s society, consumers thrive on instant gratification. If you can fulfill this desire, users will perceive your buying process to be much easier than that of your competitors.

Offering instant quotes is a great way to accomplish this while boosting the conversion rates of your ads – especially if you want your campaign to be more hands off.

On Facebook, you can do this using FB Messenger chatbots.

First, you’ll want to actually set up a chatbot so that when customers message your page on Facebook, the chatbot can provide them with a quote instantly while converting them into a lead.

Once your bot is set up, you can get people to message your Facebook page with Facebook’s Messenger ads.

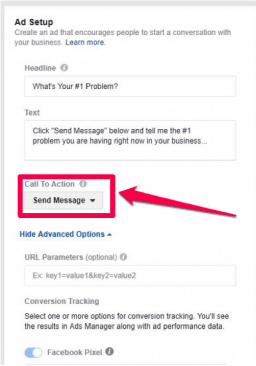

Basically, messenger ads are Facebook ads that allow you to use the call-to-action button to start a conversation with your page on Facebook instead of sending them to your website, making your ads call-to-action look like this:

Once clicked, the user will be able to instantly send your page a message that your chatbot can respond to.

Analyze and adapt

When running Facebook ads, the most important thing to keep in mind is to let your data to tell you what’s working and what isn’t.

Facebook’s ad analytics provide lots of valuable information about who’s clicking your ad, which ones are converting into leads, and which ad campaigns aren’t working at all.

It’s important to understand that creating a successful Facebook marketing strategy won’t happen overnight.

It can take a good amount of time and experimentation before you find something that will bring profitable customers your way, so starting with a smaller budget until you’ve found something that works is a good idea.

Additionally, when looking at the data provided by Facebook, it’s important to keep your focus on the end result of the campaign.

If one ad is getting fewer clicks, but the conversions from that ad are resulting in higher overall leads generated, it might be better to invest more into that ad than continuing to optimize your ads that get higher click-thru rates.

Creating Facebook Ads for Life Insurance Agents

Creating Facebook ads for insurance agents to generate leads is a low cost and highly effective advertising strategy, compared to many other advertising methods.

Many businesses are making use of Facebook ads in a way that generates profit, and life insurance agencies are no exception to this, the leads can go right into your CRM or email marketing automation., the leads can go right into your CRM or email marketing automation..

If you follow the proper process when creating your Facebook ad, you’re much more likely to find success.

There is not one way to run a Facebook ad campaign – it’s important to find the one that works for you.

Which means you will have to go through a bit of trial and error to optimize your campaigns and get your results dialed-in.

Develop great visuals, target the right audience, and optimize your campaign for performance, and you’ll be on your way to more leads and sales before you know it.

Today’s post on Faceook ads for insurance agents was written by a guest author.

Nick Rubright is the content marketing specialist for SaleFreaks – a retail arbitrage tool for dropshippers. If he’s not writing blog posts, he’s likely hanging out at the local music store.