We created this infographic sharing 11 InsureTech trends that are disrupting the insurance industry in 2020 and beyond.

For agency owners and decision-makers, these are trends worth paying attention to if you aren’t already investing in some of these technologies for your agency.

Some of these technologies are specific to certain lines of insurance, such as Blockchain with Commercial Insurance. However, other trends on this list, such as integrating marketing & service, are crucial for any insurance broker, especially independent agencies trying to compete.

After learning about these tech trends, you can use our tutorials prepared for independent agents and agencies who are looking to integrate their marketing channels and improve their engagement with consumers online.

Copy/Paste to Share on Your Site

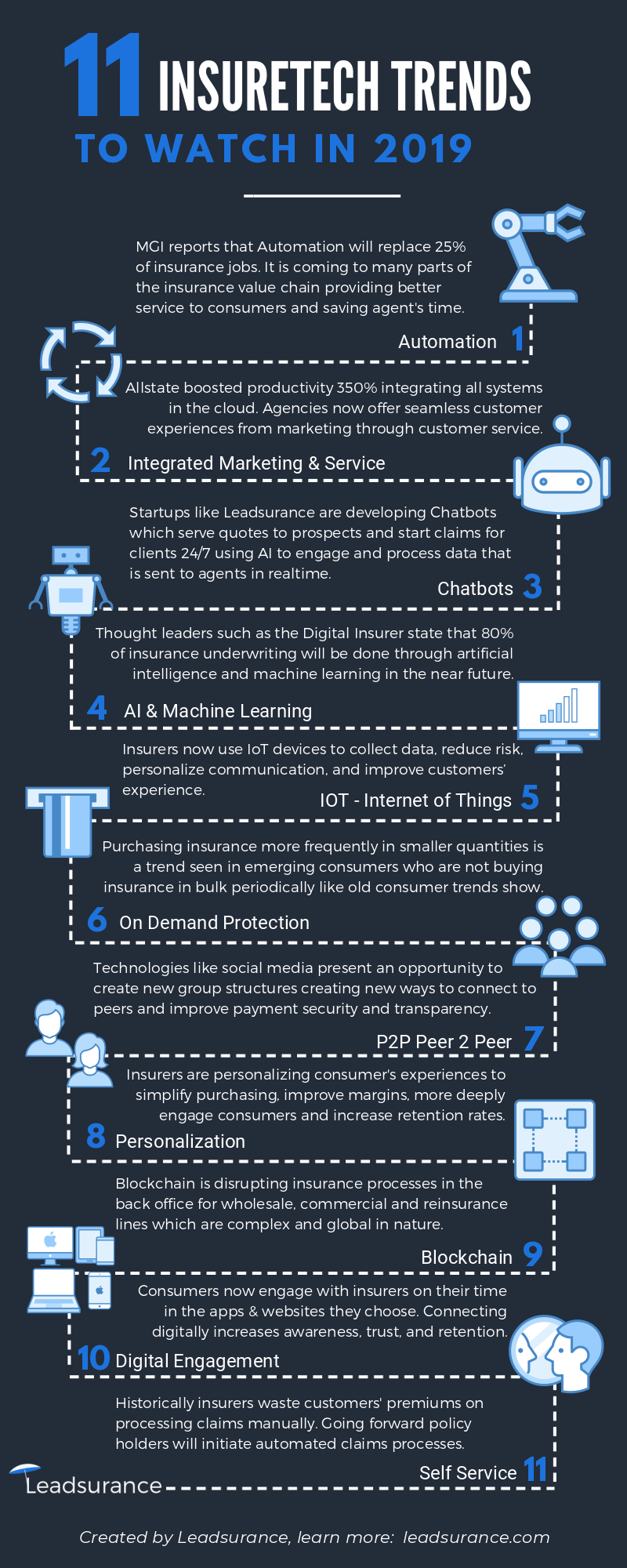

1.) Automation

MGI reports that Automation will replace 25% of insurance jobs. It is coming to many parts of the insurance value chain providing better service to consumers and saving agent’s time.

2.) Integrated Marketing and Customer Service

Allstate boosted productivity 350% integrating all systems in the cloud. Agencies now offer seamless customer experiences from marketing through customer service.

3.) Chatbots

Startups like Leadsurance are developing Insurance Chatbots which serve quotes to prospects and start claims for clients 24/7 using AI to engage and process data that is sent to agents in real-time.

4.) AI & Machine Learning

Thought leaders such as the Digital Insurer state that 80% of insurance underwriting will be done through artificial intelligence and machine learning in the near future.

5.) IOT – Internet of Things

Insurers now use IoT devices to collect data, reduce risk, personalize communication, and improve customers’ experience.

6.) On Demand Protection

Purchasing insurance more frequently in smaller quantities is a trend seen in emerging consumers. No longer are consumers buying insurance in bulk periodically as previous consumer trends show.

7.) Peer 2 Peer

Technologies like social media present an opportunity to create new group structures creating new ways to connect to peers and improve payment security and transparency.

8.) Personalization

Insurers are personalizing consumer’s experiences to simplify purchasing, improve margins, more deeply engage consumers and increase retention rates.

9.) Blockchain

Blockchain is disrupting insurance processes in the back office for wholesale, commercial and reinsurance lines which are complex and global in nature.

10.) Digital Engagement

Consumers now engage with insurers on their time in the apps & websites they choose. Connecting digitally increases awareness, trust, and retention.

11.) Self Service

Historically insurers waste customers’ premiums on processing claims manually. Going forward policyholders will initiate automated claims processes.

Sources:

- https://www.mckinsey.com/industries/financial-services/our-insights/automating-the-insurance-industry

- https://www2.deloitte.com/us/en/pages/financial-services/articles/insurance-industry-outlook.html#

- https://www.the-digital-insurer.com/blog/insurtech-the-rise-of-the-automated-insurance-agent-aka-the-insurtech-chatbot/

- https://insuranceblog.accenture.com/personalization-the-business-of-getting-personal